The original invoice layouts were customized to meet the IRAS requirements: The service editions of these VAT invoice template could be found at c6013 VAT Service Invoice Template - Price Including Tax, and at c6014 VAT Service Invoice Template - Price Excluding Tax. This invoice template, c6021 Singapore GST Invoice Template (Sales), also named Singapore GST Billing Format (Sales), designed by, was customized based on c6007 VAT Sales Invoice Template - Price Including Tax and c6008 VAT Sales Invoice Template - Price Excluding Tax.

HOW TO CALCULATE GST IN EXCEL SINGAPORE REGISTRATION

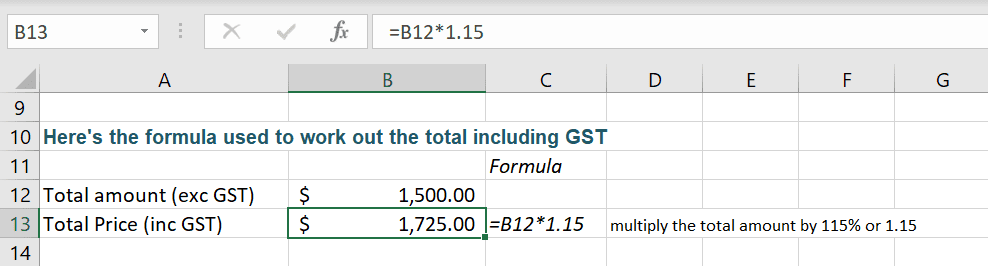

GST registration is required only if the company falls under the following: 1) The turnover is more than S$1 million for the past 12 months – known as the retrospective basis –OR- 2) There is a reason to expect that the turnover will exceed S$1 million for the next 12 months – known as the prospective basis. As a GST registered entity, you are required to submit a return to the tax authorities based on your accounting cycle, normally on a quarterly basis. GST is an indirect tax, expressed as a percentage (currently 7%) applied to the selling price of goods and services provided by GST registered business entities in Singapore. Make sure your invoices meet their requirements so that you can get paid on time.Īlso known as Value Added Tax (VAT) in many other countries, Goods and Services Tax (GST) is a consumption tax that is levied on the supply of goods and services in Singapore and the import of goods into Singapore. Note that your customers may have additional requirements regarding invoicing. Following IRAS invoice requirements will ensure that invoices are valid. Your customers usually make payments only against valid original invoices. A tax invoice need not be issued for zero-rated supplies, exempt supplies and deemed supplies or to a non-GST registered customer. In general, a tax invoice should be issued within 30 days from the time of supply. Your customer needs to keep this tax invoice as a supporting document to claim input tax on his standard-rated purchases. The template is able to calculate tax (GST - Goods and Services Tax) and totals using Excel formulas.Īs IRAS ( Inland Revenue Authority Of Singapore) states, a tax invoice must be issued when your customer is GST registered. Singapore GST Invoice Template (Sales), or Singapore GST Billing Format (Sales), meets the statutory compliance requirements that apply to Singapore private limited companies.

0 kommentar(er)

0 kommentar(er)